At a Glance

- Takeaway: Sustainability reporting is a living system that keeps adapting to new expectations and realities.

- Focus: How sustainability reporting has evolved, from GRI’s transparency focus to ISSB’s investor-driven standards.

- Why it matters: The frameworks shaping sustainability reporting now define how companies build trust, attract capital, and manage risk.

- Key shift: From voluntary impact disclosures to integrated, decision-useful information linking sustainability and finance.

- You’ll learn: The origins of GRI, the rise of SASB and TCFD, and how ISSB and ESRS are creating global alignment.

Introduction

Over the last two decades, sustainability reporting has evolved from an optional exercise in corporate responsibility into a cornerstone of business credibility. What began as a voluntary effort to share environmental and social performance has become a strategic tool for investors, regulators, and customers alike.

This shift reflects a broader transformation in business itself. Transparency is now a baseline expectation. Investors demand comparability. Regulators seek accountability. Employees and customers want evidence, not promises.

At the heart of this evolution are the frameworks that have shaped how companies measure and disclose their impact, from the early GRI standards to the investor-focused SASB and TCFD, and now the global convergence led by the ISSB.

Understanding this trajectory is a way for sustainability professionals to navigate what’s next, especially in a landscape where frameworks continue to evolve, converge, and influence how companies create value in a changing world.

The Early Years: GRI and the Age of Transparency

The story of modern sustainability reporting begins in the late 1990s with the Global Reporting Initiative (GRI). Born out of growing concern over corporate accountability, GRI introduced a new idea: that companies should measure and publicly report their environmental and social impacts with the same rigor as financial results.

The GRI standards established a foundation for consistent, comparable disclosures. They focused on impact materiality, understanding how a company’s operations affect people and the planet. This approach encouraged transparency, regardless of whether those impacts had a direct financial consequence.

GRI became the world’s first global baseline for sustainability reporting. It provided a shared language for organizations, investors, and civil society, one rooted in responsibility and stakeholder dialogue.

Over time, GRI’s influence grew far beyond its original scope. By 2010, thousands of organizations were using its standards to frame corporate sustainability reports, shaping a generation of reporting focused on transparency, accountability, and completeness.

But as sustainability moved closer to the core of business strategy, a new demand began to emerge, one that focused less on reputation and more on financial relevance.

The Investor Era: SASB and TCFD

By the mid-2010s, investors were asking a different question: not just how companies affected society, but how sustainability affected enterprise value.

Two frameworks came to define this new investor-centric era: SASB and TCFD.

The Sustainability Accounting Standards Board (SASB), founded in 2011, introduced sector-specific standards designed to highlight financially material ESG issues. A manufacturing company, for example, would report on energy efficiency and supply chain management, while a bank would focus on lending practices and data privacy.

In parallel, the Task Force on Climate-related Financial Disclosures (TCFD) (established by the Financial Stability Board) brought climate risk directly into the financial mainstream. Its recommendations pushed companies to disclose how climate change could affect business strategy, risk management, and financial performance.

Together, SASB and TCFD reframed sustainability reporting as a tool for risk assessment and investor decision-making. They shifted the emphasis from moral responsibility to business resilience.

For the first time, sustainability and finance were speaking the same language.

The Convergence Moment: ISSB and the Path Toward Alignment

As sustainability reporting matured, the proliferation of frameworks became both a strength and a challenge. Each served a different audience and purpose, but for companies operating globally, this patchwork created complexity.

In 2021, the International Sustainability Standards Board (ISSB) was established under the IFRS Foundation to address that fragmentation. Its goal: to create a globally consistent baseline for sustainability-related disclosures focused on enterprise value.

The ISSB standards (IFRS S1 and S2) are built directly on the foundations of SASB and TCFD, offering investors a clear and comparable view of how sustainability risks and opportunities affect financial performance.

At the same time, the ISSB does not replace GRI, it complements it. The two frameworks represent different but compatible lenses:

- GRI focuses on impact materiality — how the company affects society and the environment.

- ISSB focuses on financial materiality — how sustainability affects the company’s value and future performance.

Together, they form the foundation of the double materiality concept now embedded in European reporting frameworks such as the European Sustainability Reporting Standards (ESRS) under the CSRD.

This convergence is also visible in the EU’s Voluntary SME Standard (VSME), designed to help smaller companies disclose relevant sustainability information without facing the same complexity as large listed entities.

While their scope differs, the direction is the same: global consistency, local relevance, and higher credibility.

From Reporting to Decision-Making

Today, sustainability reporting has transcended its original purpose. It’s more than a document for investors or NGOs; instead, it’s a decision-making system embedded within business operations.

Companies use sustainability data to evaluate investments, forecast risks, and design strategies that balance profitability with long-term resilience.

This shift reflects the growing integration of sustainability and finance, where non-financial metrics increasingly determine financial outcomes.

Even amid shifting regulatory timelines, the momentum is clear. Delays in EU directives haven’t slowed market expectations. Investors still ask tough questions about climate risk and governance. Customers still expect traceability, and employees still want transparency.

In other words, sustainability reporting has become a living discipline, one that evolves continuously, shaped by new risks, technologies, and stakeholder demands.

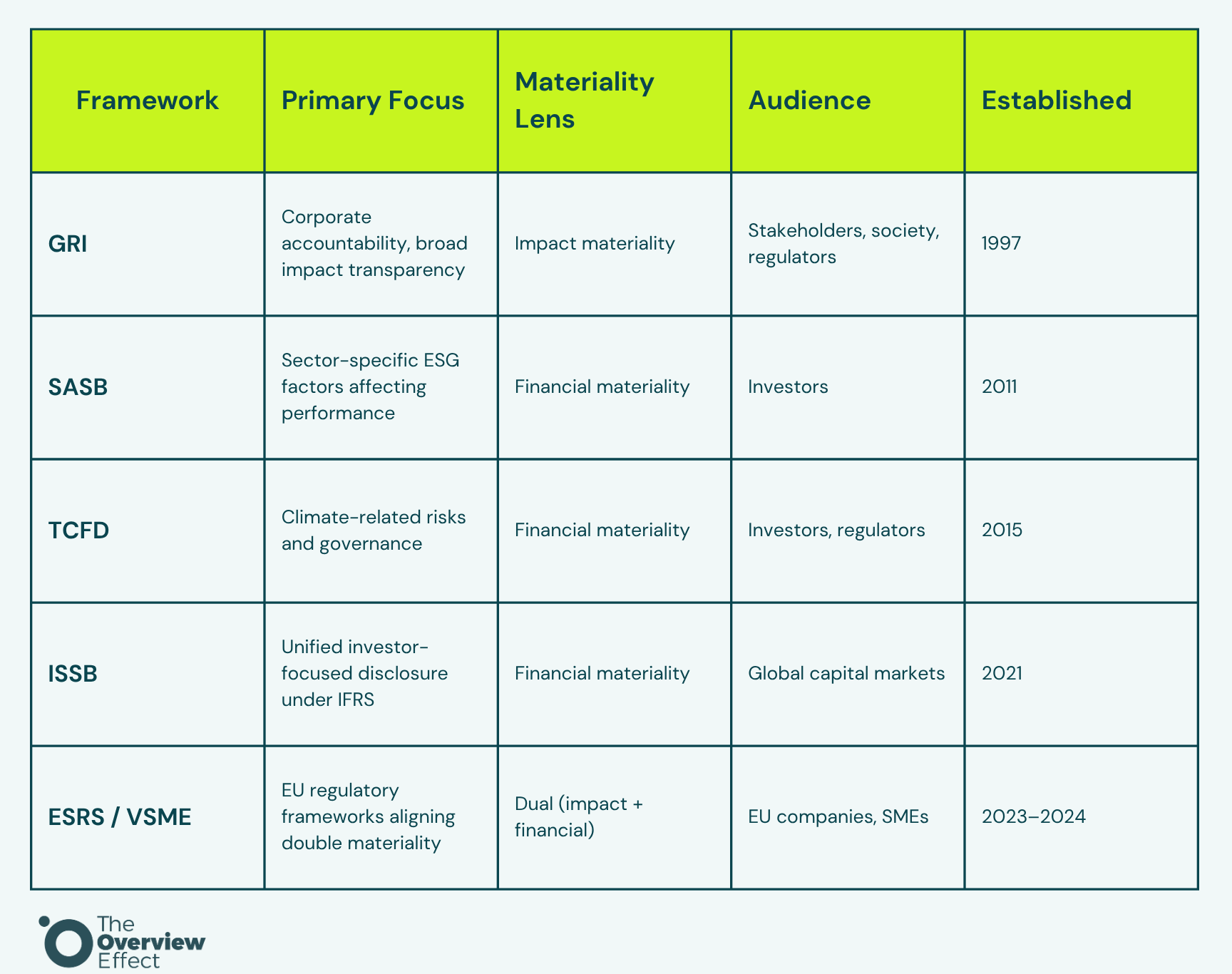

A Snapshot of Framework Evolution

A Story Still Being Written

The evolution of sustainability reporting frameworks tells a broader story, one of increasing maturity, accountability, and convergence.

What started as a voluntary experiment in transparency has become a fundamental part of how businesses communicate performance, manage risk, and plan for the future.

The frameworks may continue to evolve, but the direction is unmistakable: toward transparency, comparability, and accountability.

Sustainability reporting is about building credibility and shaping a business fit for the future.

If your organization is navigating this changing landscape, our collective of senior sustainability experts helps turn complex reporting requirements into clear, credible communication.

Explore our sustainability reporting services to see how we support companies in moving from compliance to clarity.

FAQs: Sustainability Reporting

Sustainability reporting is the process of measuring and disclosing a company’s environmental, social, and governance (ESG) performance. It helps organizations communicate how they manage risks and opportunities related to sustainability and how these impact long-term value creation.

The most widely recognized frameworks include:

–GRI Standards — focused on broad stakeholder transparency and impact materiality.

SASB Standards — sector-specific, emphasizing financial materiality.

TCFD — centered on climate-related risks and governance.

ISSB Standards — integrating SASB and TCFD under the IFRS Foundation for investor-focused disclosure.

ESRS and VSME — the EU’s double-materiality frameworks aligning regulatory and voluntary approaches.

Sustainability reporting began as voluntary transparency under GRI, expanded into investor relevance with SASB and TCFD, and is now converging through ISSB and ESRS frameworks. The field continues to evolve toward global consistency and data-driven accountability.

Beyond compliance, sustainability reporting builds credibility with stakeholders, informs strategic decisions, and improves resilience. It’s how companies show progress, manage risk, and demonstrate accountability in a changing global economy.